Perspectives

Tariffs & the Potential Impact on Auction Vehicle Prices

Published May 30, 2019 - Written by Sebastian Gancarczyk

10 Min read

Summary

Sebastian Gancarczyk, Vice President of Finance, digs into the impact these tariffs could have on the auto industry. Specifically, he explores the potential direction and magnitude the current and proposed tariffs could have on prices for new and used vehicles, auto parts, and scrap.

In January 2018, the U.S. Department of Commerce submitted their investigation to the President regarding the importance domestic steel and aluminum products have on national security.1 A variety of steel product prices shot up shortly afterward.2

In March 2018, the White House issued tariffs on U.S. imported steel and aluminum in an effort to protect national security and domestic steel and aluminum manufacturing jobs. The proposal moved markets on the day of the announcement, with stock from domestic metal-producing companies like U.S. Steel and Century Aluminum up 7 percent, and companies within steel and aluminum consuming industries seeing decreases in their share prices.3

The Department of Commerce began a 270-day investigation into initiating a 25 percent tariff on imported automobiles and automobile parts in May 2018.4 The report was submitted to the White House on February 17th, 2019, and on May 17th President Trump instructed U.S. Trade Representative Robert Lighthizer to begin tariff negotiations with the countries of concern over the next 6 months.5 Japan, Germany, South Korea, and the United Kingdom look to be hit the hardest by any tariffs issued as a result of the negotiations.6

In this article, we dig into the impact these tariffs could have on the auto industry. Specifically, we explore the potential direction and magnitude the current and proposed tariffs could have on prices for new and used vehicles, auto parts, and scrap.

A Brief Tariff Primer

Simply put, a tariff is a tax on an imported good or service. For example, with steel tariffs set to 25 percent, if a company purchases $100,000 worth of imported steel, the same company would pay an additional $25,000 to the government. The same amount of domestically produced steel previously offered for $100,000 becomes relatively cheaper than the foreign steel, increasing demand and pushing domestic steel prices higher.7 The domestic and foreign steel prices could reach an equilibrium at some point between $100,000 and $125,000, everything else equal.

This is not just a theory – it has happened in practice. In 2002, the U.S. imposed steel tariffs, with the last set of duties ranging from 8 percent to 30 percent. A study of the trade tax found that from December 2001 to December 2002, steel price indices for hot- and cold-rolled steel were up 27 percent and 21 percent, respectively. While they were unable to tie specific estimates to the tariff’s role in increasing steel prices, the authors found it to be “clear that the Section 201 tariffs played a leading role in pushing prices up.”8

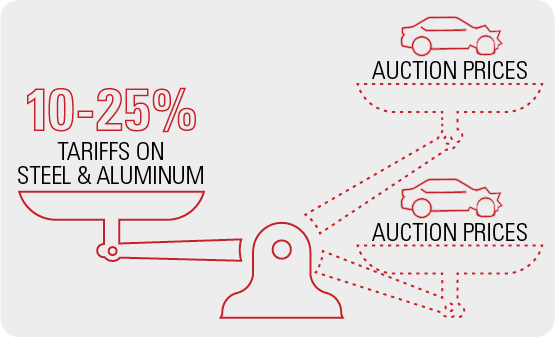

Metal Tariffs

If steel and aluminum could potentially be more expensive after a tariff is imposed, how might that influence vehicle prices? The Department of Commerce addressed this in their initial investigation, stating, “Higher input costs (as a result of tariffs) for downstream domestic producers (like auto manufacturers) are likely to lead to… higher prices for consumers.”9 Morningstar Analytics published a study on the potential impact the tariffs could have on a number of industries. For the auto industry, their methodology was straightforward. They estimated the current value of steel and aluminum in new vehicles, taxed each metal at their respective tariff rate, and added that tax to the value of the vehicle. Their findings agree with Commerce’s assessment, concluding that the tariffs could push new-vehicle prices upward – with an average increase of 1 percent to vehicle values.10

The effect these metals tariffs may have on salvage space could yield similar results. Raw materials could become relatively more expensive than before the tariffs, so scrap and parts prices increase, potentially putting salvage vehicles in higher demand and pushing prices up. Of course, salvage prices depend on many factors other than just steel and aluminum. These would include movements in exchange rates, economic growth, unemployment, average wages, and the overall supply of salvage vehicles at auction, just to name a few.

Auto Parts Tariffs

Similar to metals tariffs, a tariff on imported auto parts could also push vehicle prices upward. Published in June 2018, a study by the Peterson Institute uses research that examined changes in vehicle prices before and after tariffs were applied to Japanese trucks and motorcycle imports in the 1980’s. Combining that research with the foreign parts content in some of the most popular sold models in the U.S., they found that a 25 percent auto parts tariffs would lift vehicle prices by 8.4 percent for compact cars, 9.3 percent for compact SUVs, and 13.4 percent for luxury SUVs. The vehicle models the authors studied represent about 20 percent of all vehicles sold in 2017. The authors gave a nod to the used-vehicle market as well, putting the relationship between new and used-vehicle prices succinctly, “When new car prices rise, used vehicles become more valuable because some households no longer can afford to buy a new car. Holding suddenly more desirable inventory, used car dealers raise prices to meet the now higher demand for previously owned vehicles.”11

The Center for Automotive Research found auto parts tariffs to have a similar effect on sticker prices. They provide an analysis on a number of possible scenarios, ranging from a 10 percent to 25 percent tariff, with and without exemptions to Mexico and Canada auto part imports. In 2017, Mexico and Canada represented about 48 percent of all imported auto parts. Their exemption would prove nontrivial to the impact they would have on prices.12 For an average $30,000 new vehicle, their analysis estimates auto parts tariffs could increase prices by anywhere from 1.5 percent (10 percent tariff with Mexico and Canada exemptions, U.S.-assembled vehicles) to 14.6 percent (25 percent tariff, no exemptions, all U.S. sold vehicles). Further discussion and analysis on the particulars of these scenarios are laid out in the report.13

We do not have to speculate about what auto parts tariffs would do to prices. Effective September 24th, 2018, the United States Trade Representative released a new tariff schedule on Chinese imports. The schedule included a 10 percent tariff on about $10B worth of auto parts imports (up from 2.5 percent), and was set to increase to a 25 percent tariff effective January 1st, 2019.14 The planned increase has since been delayed twice, but was ultimately put into effect on May 10th of this year.15, 16, 17 In anticipation and response, both domestic vehicle and vehicle parts manufacturers reported that they have or plan to pass the tax on to consumers.18 To put this recent development into perspective, a full pass-through of the 15 percentage point jump in the tariff rate reflects about an $85 increase per 2018 new-vehicle sale.

Dialing It Back – Some Caveats

There are a number of other reasons vehicles, vehicle parts, and metals prices may not climb as much these studies and reports suggest.

Each granted tariff exemption could reduce these tariffs’ influence. As of November 15th, 2018, Commerce has granted a combined 13,466 exemptions from 18,023 (74.7 percent) exclusion requests for steel and aluminum products.19

The Morningstar and Center for Automotive Research studies assume a 100 percent “pass-through” rate, meaning that all vehicle input price fluctuations would be passed on to the consumer. Indeed, two papers published this year that studied the pass-through rate of 2018 tariffs find evidence for just that. 20, 21 However, it is possible for a number of reasons that this may not turn out be true, or true beyond the scope of the current and developing set of tariffs. A strength of the Peterson Institute study is that it uses a range of pass-through rates (66 percent to 100 percent) in their analysis. A non-exhaustive list of reasons for a 100 percent pass-through rate to not occur include:

Foreign metals and parts suppliers may choose to bear some or the entire burden of tariffs on their products (for example, by charging lower prices to maintain competitiveness with domestic suppliers).

Manufacturers may absorb some of these costs by minimizing existing cost inefficiencies elsewhere in their business.

Futures contracts from automobile manufacturers for the two metals may potentially stymie at least some short-term price movements in raw material costs.

The countries from which imported steel and aluminum are sourced matter as well. Currently, Australia is the only country exempt from some form of trade restriction on the two metals.22 As mentioned earlier, Mexico and Canada supply a nearly 50 percent of U.S. auto parts imports. A reversal of the tariffs imposed on the two countries about a year ago was announced May 17th of this year. 23 This agreement will likely have put downward pressure on metals, and thus, vehicle prices.

The extent to which larger vehicle manufacturers source their metals and auto parts needs domestically matter. The less these manufacturers depend on foreign-sourced metals and auto parts, the less impact tariffs may have on prices.

Tariffs are unlikely to exist in a vacuum, and impacted countries may retaliate with their own set of tariffs on U.S. exports.24 There is concern about the consequences of these tariff responses, which have the potential to lead to reduced global trade. More specifically, any foreign tariff on auto-related U.S. exports would likely put downward pressure on demand for U.S. vehicles and vehicle parts. As of October 10, 2018, Turkey has issued retaliatory tariffs on U.S.-imported vehicles, whereas the European Union and India have issued tariffs on U.S.-imported motorcycles.25

Conclusion

In sum, the impact of tariffs on U.S. imported steel, aluminum, and auto parts may effect both downstream domestic and foreign consumers through the potential for a significant bump to vehicle prices. Specifically, the studies and reporting we cite suggest that steel and aluminum tariffs could lead to a 1 percent increase in new-vehicle prices, with a similar impact on used cars. Auto parts tariffs could likely put greater upward pressure on vehicle prices, with the largest estimate indicating average new-vehicle prices would increase by 14.6 percent. With used-car inventory then cheaper relative to new-vehicle prices than before, an influx of demand may push their prices higher as well. Auto parts sellers have reported that recent Chinese tariffs will be passed on in the form of higher prices. Scrap prices, on the other hand, have fallen slightly from multi-year highs in April 2018, but remain high adjusting for seasonal movements. Moving forward, IAA will continue to monitor both the impact existing tariffs have on prices and any new developments regarding ongoing tariff investigations.

https://www.nytimes.com/2018/03/01/upshot/trump-tariff-steel-aluminum-explain.html

https://piie.com/blogs/trade-investment-policy-watch/next-trade-wars-autos

https://www.nytimes.com/2018/03/01/upshot/trump-tariff-steel-aluminum-explain.html7

https://twitter.com/realDonaldTrump/status/1099803719435239426

https://www.bloomberg.com/news/articles/2018-08-16/trump-tariffs-force-higher-prices-on-brakes-tires-at-retailershttps://www.wsj.com/articles/latest-u-s-tariffs-could-make-auto-parts-pricier-1537349403

https://www.cbp.gov/trade/programs-administration/entry-summary/232-tariffs-aluminum-and-steel