Perspectives

Waiting for the Repossessions to Arrive

Expected Post-Pandemic Surge Delayed for Now

Published November 3, 2021 - Written by IAA, Inc.

6 Min read

Summary

Auto industry experts are still waiting on an expected surge in repossessed vehicles, but several critical factors are keeping repossessions at bay.

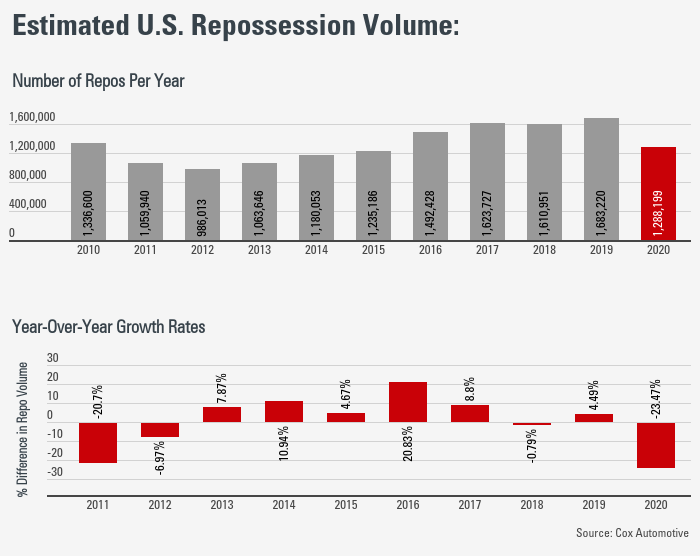

Between the pandemic, semiconductor chip shortage, and other factors, auto markets have had an interesting year to say the least. According to the Manheim Used Vehicle Value Index, used car prices were up 27% year-over-year in September.1 While the rise can be linked to chip supply issues and demand pressure in the form of stimulus checks for consumers, another important factor has been a fall in auto repossessions during the pandemic. For perspective, according to Cox Automotive, repossessions fell by 23.5%, from 1.7 million in 2019 to 1.3 million in 2020.2 The reduction in repossessions has been weighing on the used car market, contributing to a shortage of vehicles and impacting the market for repossession service providers.3 At the beginning of 2021, many industry experts, such as Car and Driver4 and Black Book5, were calling for a surge in repossessions, but to date, it looks like the industry is still waiting for them to arrive.

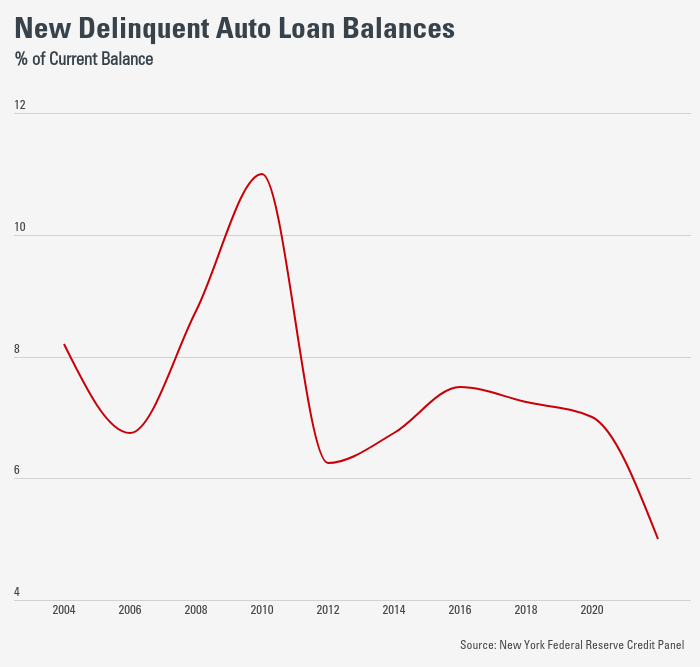

As unemployment was rising during the pandemic, so too were the challenges of paying mortgages, rent, credit cards, and auto loans for many households. For context, according to the Consumer Financial Protection Bureau, consumer complaints pertaining to auto loans and leases increased 27% from 2019 to 2020, with a majority of complaints related to managing the loan or lease.6 In response to these concerns, many states passed legislation and many automotive finance companies offered payment and repossession moratoriums. According to National Consumer Law Center data, 15 states passed legislation or executive orders limiting repossessions during the declared emergency period.7 Regardless of legislation, many automotive finance companies offered payment deferrals in the early days of the pandemic, or flexible payment options and an overall willingness to work with consumers facing payment challenges.8 These actions, combined with various forms of government support, such as stimulus checks, helped drive down auto loan delinquencies in 2020. New York Federal Reserve data shows that in Q1 2020, roughly 6.9% of auto loan balances became newly delinquent. By the fourth quarter this number had fallen to 5.5%.9 In short, fewer cars were repossessed in 2020.

At the beginning of 2021, several industry experts predicted a surge in repossessions that were essentially delayed by the pandemic. Car and Driver10 and Black Book11, among others, forecast increases far exceeding recent pre-pandemic highs in repossessions. Yet midway through 2021, these increases have yet to arrive, according to Cox Automotive.12

There are several reasons why repossessions might increase in the future.

First, many of the consumer options and moratoriums delaying repossessions have been phased out. According to recent research from the Federal Reserve Bank of Chicago, about 2-3% of subprime auto loans were in forbearance in January 2020.13 The percentage of subprime auto loans granted forbearance jumped to an estimated 18-19% in April 2020, and has fallen back to near pre-pandemic levels as of April 2021.14 Essentially, this data indicates there are fewer subprime auto loans that are in forbearance in 2021 relative to the same time last year.

Second, according to the Federal Reserve Bank of New York, the amount of auto loan debt also increased each quarter during the pandemic, ending at $1.37 trillion in 2020, a number which has increased to $1.42 trillion by the second quarter of 2021.15 In short, there is more auto debt outstanding in 2021 relative to the pre-pandemic period. This is particularly interesting given that the number of auto loans outstanding has fallen from 116.4 million in the first quarter of 2020 to 112.8 million in the second quarter of 2021.16 Accordingly, there are fewer auto loans outstanding but with a larger aggregate debt burden.

Third, the rising prices for used vehicles are linked to high demand and low supply in the marketplace, which suggests there is currently a shortage of used vehicles.17 Given that repossessed vehicles are one source of supply for the used car market, there is currently an increased demand for repossessed vehicles.18 For perspective, throughout 2020, the number of wholesale vehicles fell by 1.6 million due to fewer repossessions and overall slower economic activity.19 Cox Automotive projected an increase of 900,000 vehicles in 2021, linked to dealer businesses continuing their economic recovery and a rise in repossessions.20

So the question remains: is there in an increase in vehicle repossessions on the horizon? On one hand, as noted above, many of the moratoriums enacted to protect consumers from repossessions have ended, there are currently fewer auto loans outstanding with more debt than prior to the pandemic, and the used car market has a strong demand for repossessed vehicles given the current high prices and used vehicle shortage. These factors make a case for a possible increase in repossessions in the future.

On the other hand, it appears the economic recovery, combined with continued government support, has helped to keep repossessions at bay for now. Federal Reserve Bank of New York data shows continued declines in new auto loan delinquencies throughout the first half of 2021, falling to 5.1% of the current balance based on Q2 data. Additionally, data from the Bureau of Labor Statistics indicates that employment in the repossession services industry was down 19.8% from January 2020 to March 2021, meaning there are fewer workers in the repossession industry to serve this market. If repossessions are going to increase in the future, employment levels will likely have to increase back toward pre-pandemic levels, which has not yet happened according to the latest data.

While there are many arguments for an increase in repossessions in the future and the market may be waiting for these repossessions to arrive, only time will tell if this becomes a reality.

View IAA's stance on Forward-Looking Statements

https://publish.manheim.com/content/dam/consulting/ManheimUsedVehicleValueIndex-WebTable.png

https://www.caranddriver.com/news/a34813379/auto-repossessions-predicted-up-2021/

https://www.blackbook.com/market-insights/covid-19-market-insights-1-5-2021/

https://library.nclc.org/node/2375211/email-article#content-7

https://www.caranddriver.com/news/a34813379/auto-repossessions-predicted-up-2021/

https://www.blackbook.com/market-insights/covid-19-market-insights-1-5-2021/

https://www.cnn.com/2021/07/08/business/car-prices-inflation/index.html

https://www.autonews.com/retail/used-vehicle-demand-boosts-values-repos