Perspectives

Serving Customers in a Self-Service World

Published May 31, 2016 - Written by John Kett

4 Min read

Summary

It’s no surprise that customer service expectations have changed over time, so how should insurance carriers approach it in a self-service world? IAA’s John Kett discusses the organization’s philosophy and technological prowess in providing industry-leading customer service solutions for carriers and their policyholders.

Transformation comes in many forms. Every now and then, a single event will disrupt an entire industry, changing customer expectations overnight. The iPhone, for example, redefined the mobile phone market, forever changing what customers thought a phone could be. It may not have been the first smartphone on the market, but it was the smartphone that changed everything.

However, transformation often takes a very different path. It manifests itself through a gradual series of shifts and recalibrations that eventually lead to something entirely different than what we’ve known. Such is the case with customer service expectations in 2016. Consumers are making their voices heard, and turning the traditional model on its ear. And with near unanimity, they’re demanding customer support take a new form: self-service.

The new customer (self) service equation

That customer service expectations have changed over time is not all that surprising. You could argue it was bound to happen as technologies evolved and processes matured. What is surprising, however, is the overwhelming preference customers have shown for the self-service model. According to a 2015 Parature report, 90% of consumers expect companies to offer a self-service customer support portal. 73% want the ability to solve a problem on their own and, perhaps most telling, one third indicated they’d “rather clean a toilet” than call customer service. Not exactly the kind of feedback companies like to hear.

It better be fast

Customers expect more than just choice these days, too. A Fast Company study found 39% of consumers expect a response to a customer service inquiry within four hours. When Fast Company limited their responses to social media users, the expected turnaround time fell even more. These findings align with research conducted by Forrester, which found that 77% of consumers consider valuing their time to be the most important thing a company can do to provide good online customer service.

In order to meet these lofty expectations, a self-service model is often the only realistic option, and it’s where the insurance industry is headed. Several major P&C carriers already offer self-service filing apps that allow the vehicle owner to initiate the claim process on their own. By submitting a few photos through these apps, customers can manage the claim process from beginning to end, at their convenience and on their schedule. What would have been impossible just a few years ago is now literally at the customers’ fingertips.

Learning by doing

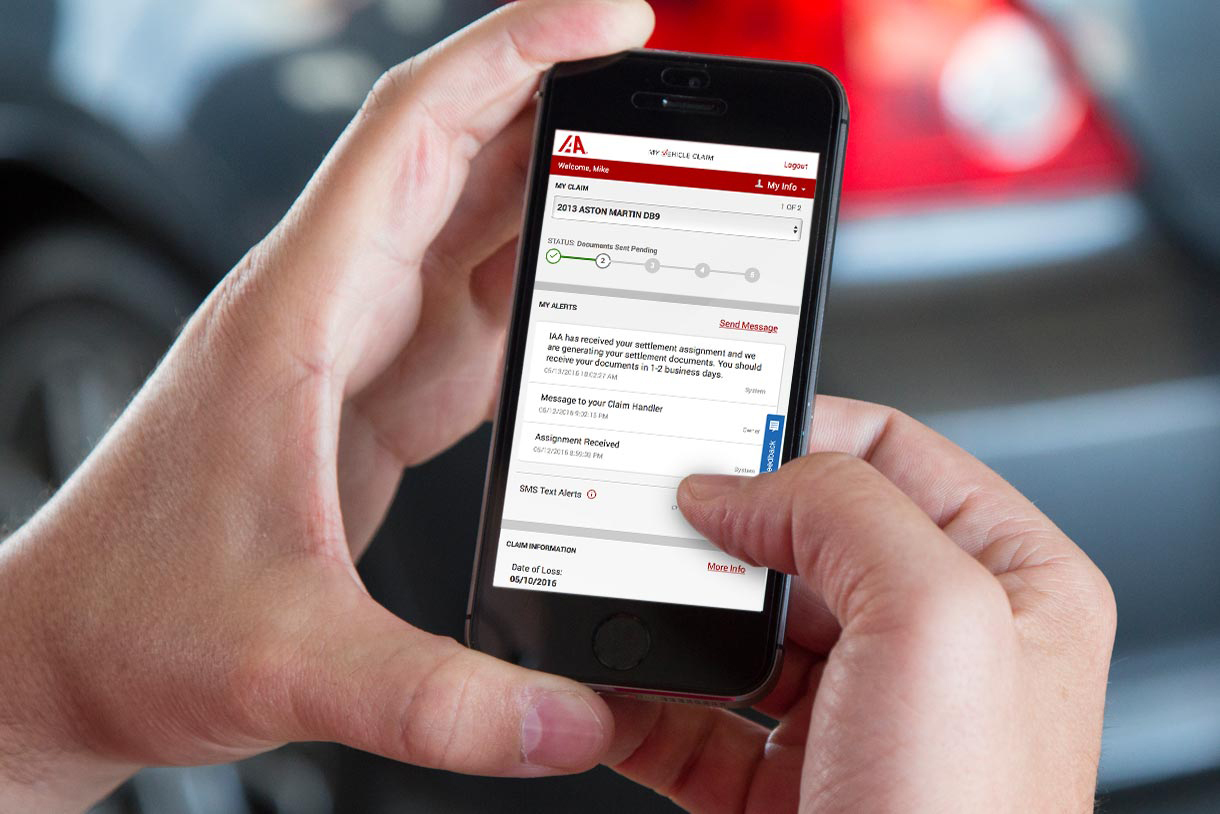

MyVehicleClaim.com, one of our recent IAA Total Loss Solutions™ offerings, is a perfect example of IAA’s response to shifting consumer expectations. The site provides our insurance partners the opportunity to offer their customers a scalable self-service claims management solution from total loss determination to final settlement.

As impressive as the site’s document management functions may be, it’s the self-service aspect that we’re most proud of. When we set out to design a tool that would help carriers support their policyholders, we knew that we had to look at the solution through the eyes of a claimant. We had to account for their needs, their priorities and, most importantly, their expectations. In 2016, that means offering customers a timely solution that works on their terms.

The IAA team is no stranger to the self-service landscape, and was able to draw from a deep pool of experience when designing MyVehicleClaim.com. The institutional knowledge we’ve developed through the creation of tools like CSAToday® and IAA Market Value proved invaluable, and demonstrates our longstanding dedication to the self-service concept.

From tried-and-true call centers to cutting-edge mobile apps, customer service in the 21st century takes many forms. But rather than focus on the method of delivery, we choose to focus on the customer. Once you understand their needs and expectations, the rest will fall into place.

More From IAA

Pat Walsh, IAA’s Senior Vice President of Business Development, recently teamed up with Claims Magazine to discuss customer retention in the property and casualty insurance industry. The article takes an in-depth look at the drivers influencing customer satisfaction and retention, and how claims departments can leverage self-service technology to improve financial outcomes.