Perspectives

Ride-Hailing Part 1: Its Effect on Vehicle Sales

Published September 18, 2019 - Written by Sebastian Gancarczyk

9 Min read

Summary

In a two-part series, Sebastian Gancarczyk, VP of Finance at IAA discusses the impact of ride-hailing companies, and their effect on the automotive industry.

Introduction

In the early 2010’s ride-hailing companies began to operate starting with Uber, Lyft, and Sidecar. These companies had the idea that customers were interested in a service that would allow them to hail a cab or a ride with an app on their smartphone. As these firms have grown they have had transformational effects on society by changing the norms of transportation. The success of these ride-hailing companies has led two of the larger players to go public this past spring with Uber listing on the New York Stock Exchange, and Lyft on the Nasdaq.

Of course, any significant catalyst of change will face challenges and its benefits to society must be carefully weighed against its costs. The obvious benefit is the simple convenience that ride-hailing has provided for individual passenger transportation needs--this combined with the efficiency of mobilizing the excess capacity of peoples’ vehicles, creates new primary and secondary income sources for drivers. There are many other potential benefits as well, such as the reduction in DUI-related and fatal car accidents after several years of ride-hailing entry, and even a reduction in parking demand.1,2

These benefits do not come without their share of costs. Concerns over excessive traffic congestion, passenger safety, and corporate treatment of drivers have become regular critiques of this industry. In many cases these concerns have led to these ride-hailing services being banned (sometimes only temporarily) in certain countries such as Denmark, Turkey, and parts of Australia, as well as in certain U.S. states such as Oregon (excluding Portland), and Texas. The unfortunate reality is that the relative infancy of this industry has made the long-term impacts of ride-hailing yet-to-be determined.

Of course, while big picture societal impacts are important, it is also imperative to consider specific industry or sector effects, such as the potential impact of the rise in ride-hailing services on both the automotive and salvage auto industries. While many questions come to mind, the impact of this industry on vehicle sales is specifically intriguing. As changes to vehicle sales can end up impacting the salvage auto space down the road, we look into how these fundamentals have or may change in the future as a result of ride-hailing growth. Like many economic questions, the answers to these are far from obvious and quite complex given the sheer number of contributing factors. But, our analysis below will help to explore the potential impacts of the ride-hailing industry on vehicle sales and the subsequent effects on the salvage auto industry. In a future piece, we will be extending our discussion to look at the impact of ride-hailing services on vehicle miles traveled and its spillover effects into the salvage auto space as well.

Ride-hailing & Vehicle Sales

Like any industry, sales is a key metric in the auto industry spread across the new and used markets. With the ride-sharing industry growing rapidly, that growth comes with many predictions on how this industry will affect vehicle sales in the future. The answer to this question may depend on the number of drivers that decide to switch from car ownership to using ride-hailing services as a replacement, compared with the demand for new or used vehicles by the suppliers or drivers of ride-hailing services. This impact, of course, could be compounded by the potential market effects of self-driving cars should they reach widespread adoption.

The success of these ride-hailing services hinges on the ability of society to leverage the excess capacity of vehicle usage being put to work. In other words, many cars sit idle for a majority of the day; these cars represent the excess capacity. Putting these mostly idle cars to work, we create a more efficient solution to personal transportation needs. The most direct conclusion suggests that if we are more efficiently using our vehicles, this will reduce the demand for vehicles leading to a reduction in vehicle sales in general. On the supply side, this behavior could theoretically lead to short-to-intermediate term increases in the quantity of used vehicles on the market as current drivers make the transition from vehicle ownership to using ride-hailing services. All else equal, the reduction in demand for vehicles in general combined with the increase in supply of used vehicles on the market as drivers substitute for these services could theoretically lower the sales prices in the new and used vehicle markets.

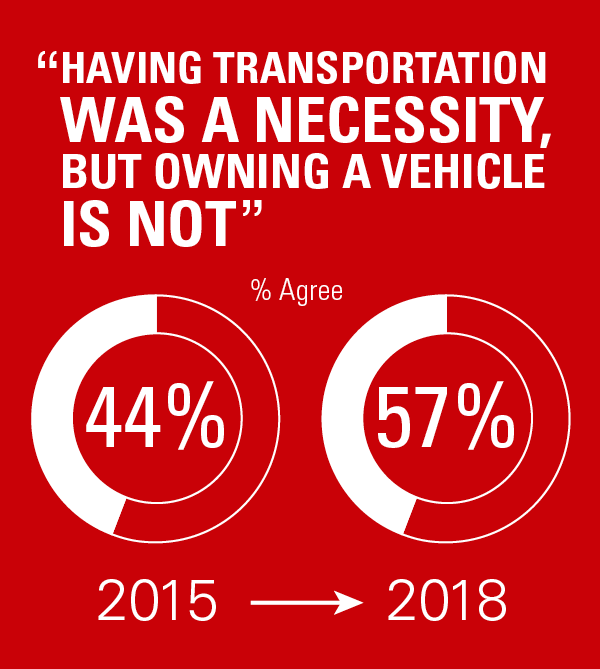

Some early research on this topic suggests evidence of this effect. With ride-hailing being a potentially cheaper short-term option available for consumers (e.g. insurance, financing, and parking savings in the short-run), many are opting out of the purchase of a new vehicle or at the very least thinking about whether or not car ownership is actually worth it, especially those in larger cities. A 2018 study by Cox Automotive found that attitudes towards vehicle ownership are changing. In 2015, 44% of urban respondents agreed that “having transportation was a necessity, but owning a vehicle is not”. By 2018, this number jumped by 13 percentage points to 57% of urban respondents agreeing with this statement. Both suburban and rural respondents were also more likely to agree with the statement in 2018 relative to 2015. These trends suggest that the rise of ride-hailing might be starting to shift consumer attitudes and behaviors.3

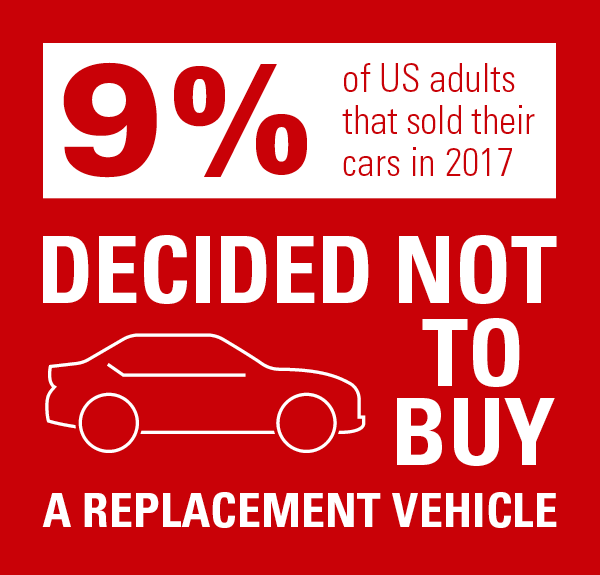

Similarly, a recent Reuters survey found that of the nearly quarter of US adults that sold their cars in 2017 about 9% of people decided not to buy a replacement vehicle and transition to ride-hailing as their primary means of transportation.4 When Austin, Texas banned Uber and Lyft for a year in 2016, researchers at the University of Michigan, Texas A&M, and Columbia University used it as the perfect case study to find out more about how the ride-hailing industry affects the average consumer. Out of the approximately 1,200 consumers that were surveyed, 9% of commuters purchased a car to make up for the void created by the loss of the ride-hailing companies.5

A UC-Berkeley study by their Transportation and Sustainability Research Center estimated that each car-hailing (including ride-hailing services and car-sharing services such as ZipCar, Maven etc.) vehicle replaces between 9 and 13 personally owned vehicles.6,7

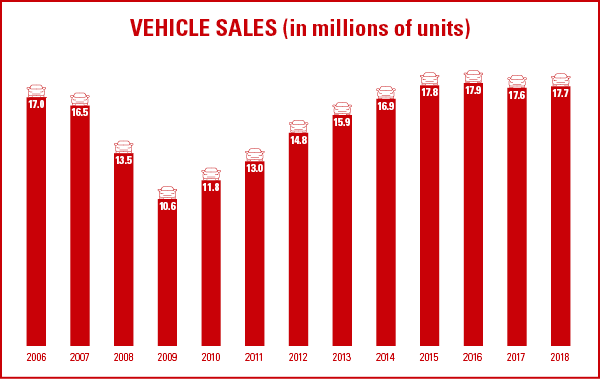

While many studies and surveys have provided situational evidence of ride-hailing customers opting to use these services in lieu of personal ownership, its impact on overall sales has been difficult to tease out. A quick look at annual new vehicle sales over the past decade shows a steady increase following the financial crisis from 10.6 million vehicles in 2009 to 17.8 million units in 2015. The average new vehicle sales from 2015-2018 has consistently fallen in the range between 17.6-17.9 million vehicles. If ride-hailing services are having a substitution effect for personal vehicle ownership it has yet to drastically impact new vehicles sales on the whole.8

While some argue that ride-hailing will result in declining vehicle sales, there are optimistic analysts that point out new vehicle sales may not drop significantly, if at all, because of ride-hailing. Full- and part-time ride-share drivers are riding more frequently, therefore increasing the vehicle’s rate of depreciation. As vehicles pass through their life spans more quickly, consumers will have to replace their vehicles more often, causing an increase in vehicle sales. Another potential reason to support this argument is that in the future, dominating ride-hailing companies may buy a significant number of new vehicles, and possibly even several vehicle manufacturers, as noted by Moody’s analysts. Ride-hailing companies will want to reduce costs, ensure their vehicles are reliable, and protect the unique technology behind the self-driving car.9

It is worth noting that only large, urban areas have consistent access to ride-hailing, while smaller, more rural populations still may have limited access to these services. The auto industry may not have faced drastic impacts in sales yet due to the fact that a large portion of the population does not have easy access to public transportation, making car ownership still a necessity in many parts of the country. For now, owning a vehicle still plays a significant role in American life. While we only scratched the surface on how ride-hailing impacts the auto salvage industry and the aftershocks of that on vehicle sales, there will likely be substantial growth in research studies surrounding the ride-hailing industry.

Ride-Hailing & Salvage Auto Industry

The availability of studies regarding how the salvage auto industry will be affected by ride-hailing is limited, but we can make some theoretical predictions based on linking the aforementioned ride-hailing impacts on vehicles sales to the salvage auto industry. So far, we have shown that while the new vehicle sales volumes have not been significantly impacted in the aggregate, there are several regionally focused studies and consumer trend behaviors that suggest more drivers may be opting for ride-hailing services in lieu of ownership. This hints at declining new vehicle sales over the longer term as one ride-hailing vehicle may serve as a replacement for multiple vehicles.

So how could all of this impact the salvage auto market? It depends.

On one hand, the used car market is likely to see short-to-intermediate term supply increases as drivers make the switch to these services. However, as ride-hailing becomes more common place and new vehicle sales slow down, this would suggest a longer-term reduction in quantity of used cars available. In this scenario, the increase in supply in the short-term would put downward pressure on prices at auction, and the lack of demand for new and used cars in the longer-term would also put a drag on prices in this market.

On the other hand, as ride hailing becomes a replacement for ownership, this puts demand side pressure on the new and used car market from the perspective of the ride hailing fleet. The ride hailing fleet obviously needs vehicles to replace the rides foregone by a lack of ownership. Additionally, the vehicles in this fleet will likely experience greater wear-and-tear, greater mileage, and ultimately faster turnover and vehicle replacement. The increase in demand on behalf of the ride hailing fleet in the short and long term will cause prices to rise at auction.

The future of the auto salvage market is linked to the age old story of supply and demand. The above scenarios paint opposing outcomes on the prices in these markets. If the fall in vehicle ownership over time is a more dominant effect than the faster vehicle turnover of the ride hailing fleet, auction prices could potentially fall. However, if the faster vehicle turnover is a more dominant effect than the falling ownership, then prices could potentially rise at auction. Of course, the third option is that these two opposing forces actually offset, leaving the market relatively unchanged, as we have seen so far. Future research needs to focus on the trade-off between falling vehicle ownership rates compared with the turnover rates of the ride-hailing fleet to truly understand the dynamics of this market.

Ultimately, this will depend on what happens to the overall vehicle miles traveled (VMT) to better understand the net effect of these market shocks, which we will analyze in a future post.