Perspectives

Forecasting Prices for Aftermarket EV Batteries

Published December 4, 2018 - Written by Sebastian Gancarczyk

6 Min read

Summary

Sebastian Gancarczyk, Vice President of Finance at IAA, discusses the future of aftermarket electric vehicle batteries in the resale marketplace.

The electric vehicle market is approaching a major milestone that will be a bellwether for the future, and industry experts and aftermarket dealers are getting charged up about the possibilities.

Since electric vehicles started rolling out to the mass market in 2010, they have been mostly powered by lithium-ion electric vehicle batteries. These EV batteries commonly come with a warranty of eight years or 100,000 miles.[1]

Drive forward eight years to 2018, and those first EV batteries are reaching their end-of-vehicle life. So, now the question heats up about what prices these valuable batteries will fetch in the up-and-coming resale marketplace.

Since the number of EV batteries slated to enter the resale market is unprecedented, there is no completely reliable way to calculate what EV batteries will be worth in aftermarket sales. What we can do, however, is take a look at what value remains in used EV batteries and what some other industry price trends tell us they could be worth.

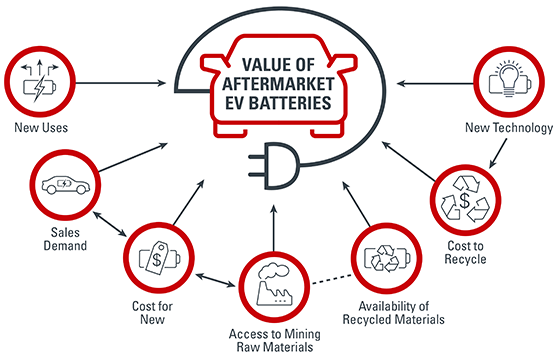

The value of a used electric vehicle battery is dependent on a number of factors, including the relationship between the cost of a new EV battery, the cost to recycle an EV battery, and demand for alternative uses of used batteries.

Uses for past-warranty electric vehicle batteries

As their warranties expire and some of these early EV batteries reach their potential end-of-vehicle life, they still hold value. Though owners may replace them, most estimates indicate used EV batteries retain 70% of their original capacity and have a useful life of about 10 years in secondary applications.[2]

A small number of used EV batteries will be discarded, but about three-quarters will be repurposed for stationary use or broken down for parts and materials, Hans Eric Melin, founder of Circular Energy Storage Research and Consulting, recently told Bloomberg Business.

Stationary uses include utilizing used EV batteries to power small machines or as storage vessels for charging stations, homes and turbines. In addition to being motivated by resale, there is also pressure to prevent the landfilling of so many used batteries.

3.4 million used EV batteries and hybrid vehicle batteries will accumulate globally by 2025.[3]

Influences on the future price of aftermarket EV batteries

A number of complex economic and technological factors bear on the price of second-use batteries, making it difficult to forecast. We will focus on some of the most salient, concrete factors for this article.

Used EV lithium-ion batteries can be viewed through the perspective of the broader battery market, which comprises both stationary storage and transportation-use batteries. The size of that market is a function of two broad factors:

Total volume of demanded battery capacity, usually measured in gigawatt-hours or kilowatt-hours

Price, usually measured in dollars per kilowatt-hour

Research and development

The development of new technologies for lithium-ion EV batteries continues to accelerate, with most major manufacturers allocating more of their R&D spend toward EV vehicle technology.[4]

Simultaneously, the U.S. Department of Energy and other government agencies are funding research in the private sector and at the collegiate level, where scholarly researchers from many disciplines put considerable time and resources toward improving the performance and reducing the cost of EV batteries.[5]

As batteries improve and prices for new EV batteries fall, electric vehicles become more cost-competitive against gas-powered vehicles. This eventually should increase the share of electric vehicles on the road, and boost demand for EV batteries.

The global resale market for lithium-ion batteries could reach $1.1 billion in 2018 and $4.2 billion by 2025, according to an estimate from research group Circular Energy Storage.[6]

Raw material matters

EV batteries contain valuable metals such as lithium, nickel and cobalt. As these raw materials become scarcer in nature and more difficult to mine, the second-life price of EV batteries may increase as recycling them could become more profitable.

Conversely, however, supply constraint on raw materials further drives the development of new battery technologies that do not require these metals. This could eventually make these materials obsolete in the EV battery industry and less relevant in the EV battery aftermarket.

Co-dependent relationships

A big piece of the puzzle in determining used EV battery prices is the reinforcing dynamic between electric vehicle demand and the price of new EV batteries. Growth in the demand for electric vehicles is largely dependent on the price of EV batteries, and vice versa.

Right now, EV batteries currently represent about 42% of a new EV vehicle’s total price, according to a report from Bloomberg New Energy Finance (BNEF), which estimates that by 2026, that portion of cost will fall to 24%.[7]

Shrinking battery costs have been a welcome trend to the EV industry in the past. In 2010, the average EV lithium-ion battery cost about $1,000/kWh. Today, that figure is closer to around $200/kWh.

Lower EV battery costs will likely decrease sticker prices, driving up sales of electric vehicles. As EVs become more popular, demand for EV batteries will heighten, applying upward pressure on their prices, all else being equal.

Our projected value for used EV batteries

A growing consensus from energy experts is that the continuing technology development of these batteries could get prices down to $100/kWh by 2025, putting the EV battery’s share of a vehicle’s price around BNEF’s estimate of around 25%, or about $6,000 for a 60 kWh battery.

Using the BNEF estimate of 95-gWh capacity, a 75% EV reuse/recycle rate, and a price at half of the expected price of new EV battery pricing, or $50/kWh, the second-life EV battery market would be around $3.56 billion by 2025. That is a conservative estimate relative to the Circular Energy Storage estimate cited earlier.

The future of EV batteries will almost certainly be one of strong growth, and will leave plenty of opportunity for a second-life market. As industry and economic conditions evolve, IAA experts track trends to develop strategies for the future.

[1] https://www.energy.gov/eere/vehicles/fact-913-february-22-2016-most-common-warranty-plug-vehicle-batteries-8-years100000

[2] https://www.nrel.gov/transportation/battery-second-use-analysis.html

[3] https://www.bloomberg.com/news/features/2018-06-27/where-3-million-electric-vehicle-batteries-will-go-when-they-retire

[4] https://www.chinadialogue.net/article/show/single/en/10808-The-race-to-develop-the-next-generation-battery

[5] https://www.energy.gov/eere/vehicles/batteries

[6] https://www.pv-magazine.com/2018/08/03/second-life-ev-battery-market-to-grow-to-4-2-billion-by-2025/

[7] https://data.bloomberglp.com/bnef/sites/14/2017/07/BNEF-Lithium-ion-battery-costs-and-market.pdf