Industry Report

2020 Industry Report Mid-Year Update

Published September 29, 2020 - Written by Sebastian Gancarczyk & Jeanene O’Brien

Summary

While 2020 began as a year of optimism and strong economic growth, the COVID-19 global pandemic has fueled unprecedented shocks to the economy and tremendous levels of uncertainty. Find out more about the state of the automotive auction industry in our 2020 Mid-Year Industry Report.

EXECUTIVE SUMMARY

ECONOMY

While 2020 began as a year of optimism and strong economic growth, the onset of the COVID-19 global pandemic has fueled unprecedented shocks to the economy and tremendous levels of uncertainty. The uncertainty and fear of the pandemic paved the way for various levels of government-driven shutdowns, all of which have led to historic falls in GDP and employment. This sudden shock to the economy triggered large-scale government support in the form of stimulus packages to individuals, businesses and corporations. Unemployment, in particular, went from near-historic lows to double digits within months. Year-over-year the U.S. dollar strengthened significantly. However, 2020 brought periods of modest ups and downs in the face of the U.S. experience with the pandemic.

AUTOMOTIVE INDUSTRY

New vehicle sales plunged 23.8% during the first half of the year. The COVID-19 pandemic has resulted in rising unemployment and uncertainty in the economy, triggering a contraction in consumer spending on big ticket items such as new vehicles. Additionally, reduced travel and economic activity as a result of COVID-19 has created a substantial decline in demand for gasoline and diesel. As a result of this shift in demand, gasoline prices dropped 16.3% during the first half of the year, while diesel prices fell a comparable 13.3%.

SALVAGE INDUSTRY

Whole crushed auto-body prices saw a severe hit in the first half of 2020 driven by low global demand and high supply backed by China’s overproduction of metals. Metals heavily relied upon by the automotive industry varied drastically in terms of price. Aluminum saw the worst performance, falling 12.9% from the first half of 2019. This can be partially attributed to a slow market in China. Platinum prices have been volatile throughout the first half of the year, crashing in April and slowly picking up in the months that followed. Palladium, used for catalytic converters in gasoline-powered cars, has hit record high prices so far in 2020 as emission standards tighten across the globe. While the used car market crashed in April, it has since recovered and is relatively stable.1,2,3,4,5

U.S. ECONOMY

The Economic Woes of the COVID-19 Pandemic

The economic momentum coming into early 2020, fostered by the longest expansionary period in U.S. history, came to an abrupt halt with the onset of the COVID-19 pandemic and the subsequent economic fallout. Unemployment was at 3.5% in February, its lowest level in fifty years, but quickly jumped to 14.7% by April. The primary measure of GDP fell by an annualized 32.9% in the second quarter, which is about a 9.5% drop in GDP from the first to second quarter. This fall in GDP put an end to the expansionary period and pushed the economy into a recession. The combination of uncertainty about the future, combined with lockdowns and shutdowns, created supply and demand shocks that rippled throughout the economy. The real impacts of this crisis were felt unevenly across sectors, with many of the service industries experiencing sharp declines in consumer spending. Industries, such as travel and transportation, restaurants and hospitality, and surprisingly healthcare (as individuals sought to avoid elective visits/ procedures), experienced some of the biggest declines. While the U.S. continues to manage the COVID-19 pandemic, the bright side is that many economic indicators are showing signs of recovery, with sectors such as housing remaining strong. However, the uncertainty of the virus will continue to weigh heavily on the speed and trajectory of the recovery.6

Labor Market Highlights the Economic Shock of COVID-19

Prior to the COVID-19 pandemic, the U.S. economy was experiencing near-historic lows in the unemployment rate, which was 3.5% in February 2020. However, one of the key economic consequences of the current circumstances has been the steep and sudden rise in unemployment. Specifically, the rate jumped to a peak of 14.7% in April and has steadily ticked down to about 11.1% by the end of June. One notable indicator that tells this story well is the weekly number of initial unemployment claims. For perspective, from the beginning of the year through the end of February, the U.S. averaged about 212,000 claims a week. Within the first couple weeks of COVID-19 lockdowns, initial claims jumped from 282,000 for the week of March 14th to a staggering 6.9 million claims for the week of March 28th. During April, initial claims averaged about 5 million per week. Fortunately, these weekly claims have since been falling, with June averaging about 1.5 million claims per week. While this indicator continues to fall, it is still significantly higher than pre-COVID-19 norms.7,8

Wages: A Story of Mixed Signals

While the current unemployment situation marks one of the fastest job loss shocks ever, the typical wage data appears deceptively positive. Median real weekly wages have actually increased significantly throughout 2020, with median weekly wages increasing from $367 to $392 from the first quarter to the second quarter. This implies that median wages have jumped by nearly 7.0%, while GDP fell significantly and unemployment spiked. This seems counterintuitive, and in fact it is when you think about income levels, unemployment, and the median. The unfortunate reality is unemployment was not evenly distributed across income levels, with low-income workers feeling more of the pinch in this crisis. According to data from the Federal Reserve, in April nearly 40% of all low-income earners lost their jobs due to this economic crisis. This is important when looking at the wage data, as the sudden increase in the median weekly wages was driven largely by the loss of workers at lower wages, which would drive the median higher. The more likely reality is many workers are currently experiencing wage cuts/furloughs or stagnant wages, although the degree of which varies across industries. This will likely be the case until the economy nears closer to pre-pandemic activity.9,10,11

Dollar Rises but Weakens in Recent Months

On average, the dollar appreciated 21.8% year-over-year from the first half of 2019 to the first half of 2020. The trade-weighted U.S. dollar index averaged 111.8 during the first two quarters of 2020, compared to 2019’s average of 91.8. However, the dollar has been on an interesting journey during the first half of 2020. The dollar appreciated 3.5% during the first four months of 2020, ending April at 113.6. However, much of that gain was lost by the end of June as the dollar subsequently depreciated 2.88%. Like many things this year, this reversal in recent months can be attributed to the coronavirus pandemic. Action taken to bolster the economy has continued to grow the debt-to-GDP ratio. There is also increased uncertainty as a result of the pandemic occurring during an election year. This has pushed concerned investors towards other currencies, such as the euro.12,13,14

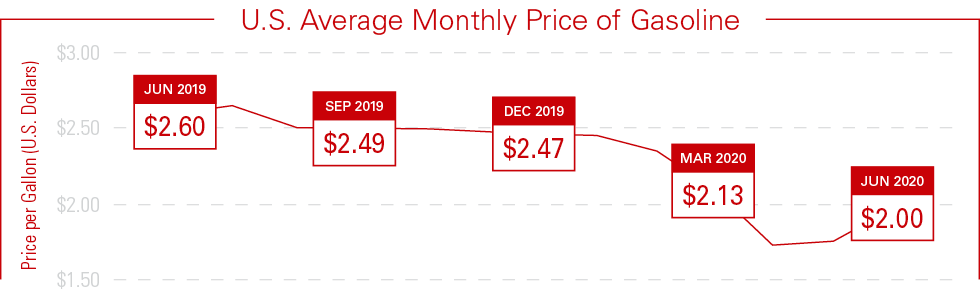

Fuel Prices: Volatility may be an Understatement

Gasoline prices were down 16.2% on average during the first half of 2020. Gasoline prices opened the year at $2.46 per gallon and fell an incredible 30%, to an average of $1.72 per gallon by April. Subsequently, gas prices climbed their way back 16.1% and ended June at an average of $1.99 per gallon. The sharp decline in the price of gasoline during the early part of the year is largely due to a decrease in demand resulting from reduced travel and economic activity caused by the coronavirus pandemic, along with tenuous oil production negotiations between Russia and OPEC.

To put this in perspective, according to the U.S. Energy Information Administration, consumption of liquid fuels in April were the lowest they’ve been since the early 1980s. This reduction helped push the price of crude oil below $0 per barrel for a short while in April. Overall, crude oil prices declined 30.8% during the first half of the year, falling from $61.17 per barrel in January to $39.27 by the end of June. Diesel prices mirrored gasoline prices, starting January at $3.07 per gallon on average and declining 21% to finish June at $2.66 per gallon. Overall, the average price of diesel for the first half of 2020 was down 13.4% compared to the first half of 2019.15,16,17,18

AUTOMOTIVE INDUSTRY

Total New-Vehicle Sales

New vehicle sales experienced a precipitous drop throughout the first half of 2020. Compared to the first half of 2019, new vehicles sales fell by nearly 24%, or roughly 2 million vehicles. As the COVID-19 virus caused widespread layoffs, furloughs, and pay-cuts, consumers shifted much of their spending away from big-ticket items and into consumer staples or savings. Like almost every other durable goods industry, the auto industry was hit hard by this shift in consumer behavior.

April sales fell to just over 700,000, which was the lowest monthly sales figure since the previous financial crisis. In response to the falling April sales, 76% of new car dealerships received PPP loans to survive until the market rebounded. There was, in fact, a sharp rebound in subsequent months, with 1.1 million cars being sold in June. That figure is still 400,000 units shy of last June’s sales.

Despite the economy largely reopening, government policy will continue to be a major factor in determining how the auto industry recovers from the current recession. However, the encouraging rebound in June could be a sign of a more prosperous end of the year for the auto industry.19,20

OVERVIEW OF SEGMENT ANALYSIS

IAA’s Five Indicators for Analyzing Salvage Vehicle Market Health Include:

Whole Crushed Auto-Body Prices: Compiled monthly by American Recycler, this measures five regional monthly averages for whole crushed car prices.

Metal Prices: Aluminum (London Metal Exchange spot prices), Platinum (Johnson Matthey base prices) and Palladium (Johnson Matthey base prices).

Vehicle Parts and Equipment Prices: A U.S. Bureau of Labor Statistics index that measures the average change over time in consumer prices paid for vehicle parts and equipment.

Used-Car Price Index: Measures the average monthly selling price of used cars and light trucks in the whole-car auction industry.

U.S. Dollar Index: A Federal Reserve Bank of St. Louis index that measures the value of the U.S. dollar against an index of seven major currencies: the euro, Canadian dollar, Japanese yen, British pound, Swiss franc, Australian dollar and Swedish krona.

ECONOMIC INDICATORS OF AUTOMOTIVE SALVAGE

Whole Crushed Auto-Body Prices

Whole crushed auto-body prices fell significantly throughout the first half of 2020. Crushed car prices dropped to $130, which is the lowest number we have seen since early 2016. Scrap steel is seeing all-time low prices due to low demand and high supply amid the pandemic. The global economy greatly affects the scrap market, and China’s slowing economy and overproduction of metals is largely attributed to the low scrap metal price21

METALS

Aluminum

The automotive industry is heavily dependent on aluminum, which has seen a slash in its price during the first half of 2020.22 The price of aluminum fell dramatically, starting January at $0.80/lb. and falling to $0.66/lb. by April. The fall in price partially stems from a lack of demand from the automotive sector as plants were idled. The metals market is also heavily dictated by China, the world’s top producer and consumer of steel and aluminum. China saw slowed demand and production in the first half of 2020. Aluminum prices have slowly begun to creep upwards in the summer months, increasing to $0.71/lb. by the end of June.23

Platinum

Platinum prices peaked in January at $993.00 per ounce before crashing in April to $761.00. According to CPM Group’s Rohit Savant, supply took a hit in South Africa, which accounts for 72% of the global platinum mine supply. Although the supply side was greatly affected, demand for platinum offset the supply shock by plummeting substantially in China, Europe and the United States. Prices picked up slightly toward the end of the first half of 2020, but are still down 12% from January.24

Palladium

Palladium prices continue to hit record highs, peaking at $2,880.00 per ounce. This is driven by increasing demand for the scarce precious metal.25 Palladium has seen a surge in demand as the metal is used for catalytic converters in gasoline-powered cars. These converters transform harmful gases into benign nitrogen, carbon dioxide, and water vapor. With stricter emission standards in Europe, China, Japan, and India, demand for the metal has steadily climbed.26

Used-Car Price Index

The KAR Used-Car Price Index hit an all-time high of 137.9 in June for wholesale used-vehicles. Although the index dropped significantly in April, the market rebounded as the supply of used vehicles tightened. The tightening used vehicle supply could be attributed to COVID-19 in several ways. First, manufacturing capacity was idled during shutdowns across the country, leaving fewer new vehicles available for purchase. Second, rising unemployment and economic uncertainty lead to consumers reducing expenditures on new vehicles. Both of these resulted in a decline in new vehicle sales and, in turn, a decline in the trade-in of used vehicles. The result is a tightening in the supply of wholesale used vehicles, leading to higher prices.27

LOOKING AHEAD

U.S. Economy Forecasts: Start of the Recovery

After Real U.S. GDP fell 5.0% in Q1 and an astonishing 32.9% in Q2 annualized (which amounts to about a 9.5% fall in GDP from Q1 to Q2), the outlook for the rest of the year is much more optimistic on a relative basis. The Third Quarter Federal Reserve Survey of Professional Forecasters are currently predicting Real GDP to grow by an annualized 19.1% in Q3 and 5.8% in the final quarter of 2020. Additionally, payrolls are expected to grow by over 2 million jobs per month in Q3. While the shape of the recovery remains uncertain, the third quarter of 2020 should mark the beginning of the recovery from an unprecedented recession. The U.S. stock market has already recovered much of its losses from March and April as investors remain optimistic that much of the economic disruption has already passed.28

Automotive Industry

The National Automobile Dealers Association (NADA) forecasts a drop in new light-vehicles sales, falling nearly 24% from 17.1 million units in 2019 to 13 million units in 2020. Decreasing sales are expected to persist despite manufacturers boosting incentives for automotive retailers. In the presence of falling sales and production shutdowns, NADA expects production to fall 29% through the first three quarters of 2020 compared to 2019. Inventory shortages are expected to continue through the end of the year even as manufacturers attempt to make up for the lost production in the first half of the year.29

Metals

Average platinum and palladium prices in 2020 are expected to fall according to BMO Capital Markets. BMO’s revised 2020 metals outlook has average platinum prices falling to $875 per ounce, a downward revision of 10.3%. Platinum supply is expected to fall by 20%, while weakened demand for jewelry and vehicles is forecasted to boost platinum inventories by nearly 10 million ounces, resulting in falling prices. BMO also revised its average 2020 palladium price down by 4.9%. Fitch Ratings has also lowered its average 2020 aluminum price from $1,680/metric ton to $1,560/metric ton citing an oversupplied market and weak automotive demand.30,31

Uncertainty Reaches All-time High

A key factor impacting the current and future states of the economy is uncertainty. From a classic economic standpoint, the general playbook in the face of uncertainty is to take a “wait-and-see” approach. This is true for both consumers and businesses. While the former has pulled back on spending and increased savings, the latter has seen a drop in investments.32,33

Uncertainty has played a key role throughout the current situation. While there are many ways to measure uncertainty, the Economic Policy Uncertainty Index, which uses algorithms to skim top news based publications for certain keywords, is currently showing all-time highs. For perspective, the uncertainty index peaked in April 2020 128% higher than the worst month of the financial crisis in October 2008. In the short-term these historic levels of uncertainty will likely continue to weigh on the economic recovery.34,35

CANADA

Canada began 2020 with an all-around stable economy, including a 5.6% unemployment rate. As the pandemic surged, various negative effects were felt, including a 12.0% drop in GDP in Q2. The unemployment rate hit an all-time high of 13.7% in May but slowly began to recover as the country reopened.36,37

Prior to the pandemic, gas prices were already unstable due to the price war between Saudi Arabia and Russia. With the combination of the pressures of the pandemic and a volatile oil market, retail gas prices dipped to 77.8 cents/liter in April. Prices are still low based on historic averages but have begun to recover and were back up to $1.01/liter as of June.38

Vehicle sales plummeted in Canada over the first half of the year, falling by 74.6% in April year over year, and over 40% in both March and May. Things have slowly begun to pick up in the auto market, with only a 16.2% drop in prices in June compared to 2019 levels. While both new and used markets struggled through the spring, there is slight optimism based on the increasing levels seen toward the end of the half of 2020.39

REFERENCES

- https://www.junkcarmedics.com/blog/scrap-car-prices-per-ton/

- https://www.indexmundi.com/commodities/?commodity=aluminum

- https://investingnews.com/daily/resource-investing/precious-metals-investing/platinum-investing/platinum-price-update/

- https://www.kitco.com/news/2020-06-09/Palladium-prices-to-remain-well-above-platinum-Commerzbank.html

- https://www.prnewswire.com/news-releases/wholesale-used-vehicle-values-reach-record-high-301090162.html

- https://www.washingtonpost.com/business/2020/07/30/gdp-q2-coronavirus/

- https://data.bls.gov/timeseries/LNS14000000

- https://fred.stlouisfed.org/series/ICSA

- https://fred.stlouisfed.org/series/LES1252881600Q

- https://fred.stlouisfed.org/series/CES0500000003

- https://www.cnbc.com/2020/05/14/40percent-of-low-income-americans-lost-their-jobs-in-march-according-to-fed.html

- https://www.bloomberg.com/news/articles/2020-08-20/time-runs-out-for-dollar-bulls-that-stretched-valuations-too-far

- https://www.bloomberg.com/opinion/articles/2020-08-21/the-euro-s-strength-against-the-dollar-might-become-contagious

- https://fred.stlouisfed.org/series/TWEXMMTH

- https://www.eia.gov/outlooks/steo/report/summerfuels.php

- https://www.eia.gov/todayinenergy/detail.php?id=44417

- https://www.eia.gov/dnav/pet/pet_pri_gnd_dcus_nus_m.htm

- https://fred.stlouisfed.org/series/DCOILWTICO

- https://www.aiada.org/news/first-up/dealers-took-least-76b-in-ppp-loans-saving-more-746000-jobs

- https://fred.stlouisfed.org/series/LTOTALNSA

- https://www.junkcarmedics.com/blog/scrap-car-prices-per-ton/

- https://www.businesswire.com/news/home/20200722005542/en/Global-Aluminum-FRP-Market-Impact-COVID-19-Highlights

- https://www.indexmundi.com/commodities/?commodity=aluminum

- https://investingnews.com/daily/resource-investing/precious-metals-investing/platinum-investing/platinum-price-update/

- https://www.rsc.org/periodic-table/element/46/palladium#:~:text=Palladium%20is%20also%20widely%20used,converters%20in%20car%20exhaust%20systems

- https://www.kitco.com/news/2020-06-09/Palladium-prices-to-remain-well-above-platinum-Commerzbank.html

- https://www.prnewswire.com/news-releases/wholesale-used-vehicle-values-reach-record-high-301090162.html

- https://www.philadelphiafed.org/research-and-data/real-time-center/survey-of-professional-forecasters/2020/survq320

- https://www.nada.org/Q2-2020-Auto-Sales-Analysis/

- https://www.fitchratings.com/research/corporate-finance/fitch-ratings-cuts-some-metals-mining-price-assumptions-on-coronavirus-hit-06-04-2020

- https://www.kitco.com/news/2020-06-25/BMO-trims-full-year-price-PGM-price-forecasts-maintains-gold-silver-outlooks.html

- https://fred.stlouisfed.org/series/PCE

- https://fred.stlouisfed.org/series/GPDI

- https://fred.stlouisfed.org/series/USEPUINDXD

- https://www.policyuncertainty.com/index.html

- https://financialpost.com/news/economy/canadian-economy-grew-4-5-in-may

- https://www.ctvnews.ca/business/canadian-economy-adds-953-000-jobs-in-june-unemployment-rate-falls-1.5018613

- https://www.statista.com/statistics/444194/average-retail-price-for-regular-unleaded-gasoline-in-canada/

- https://www.ctvnews.ca/autos/canadian-auto-sales-drop-44-per-cent-in-may-an-improvement-from-april-1.4966658